There are many instruments traders can use to improve their trading performance. Stop-Loss and Take-Profit orders are among the simplest and the most effective. They offer a chance to maximize profits and limit potential losses, getting you closer to reaching your financial goals. Keep reading to learn how to use stop-loss and take-profit orders to boost your trading results.

What Is Stop-Loss in Trading?

Stop-loss is an order that automatically closes a position if the price decreases to a certain level. It may help traders reduce losses if a deal does not go their way. For many traders, it is impossible to always keep track of their deals. By setting a stop-loss order, they can protect their capital and make sure that a losing deal closes automatically when they are not around.

How to Set a Stop-Loss Order?

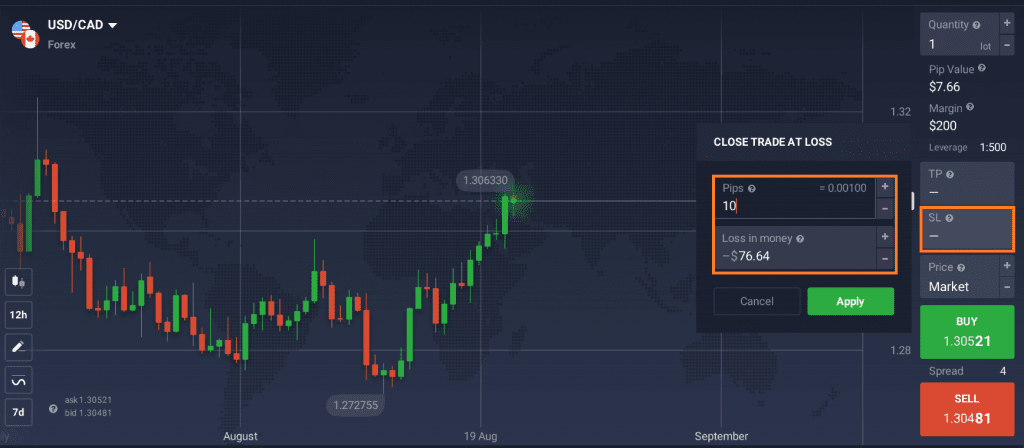

Traders can usually apply this tool directly in the traderoom. To set it up, you can just indicate the amount of money you are ready to risk on this trade. This way, the stop-loss will kick in when the loss in the position reaches that amount. Or you can specify a difference between the opening and the closing prices in pips (smallest whole unit price move). Pip value might vary, so make sure to check it before applying your order.

Take a look at this example of a trade on the IQ Option platform. The stop-loss order is set at 10 pips. This amounts to around $76 for this asset (a percentage of your initial investment calculated by the platform). Or vice versa – a trader can indicate a certain amount of money, then the pip value will be calculated automatically. Either way, the trade will close automatically if your loss in this position reaches this level.

What Is Take-Profit in Trading?

Similarly to Stop-Loss, Take-Profit is an order that closes a trade automatically when a price reaches a predetermined level. However, in this case, the goal is not to reduce losses, but to get the maximum profit. This means that the deal will close when the price increases and arrives at a certain amount. By using this tool, traders can benefit from market volatility and catch the best moment to exit a trade in profit.

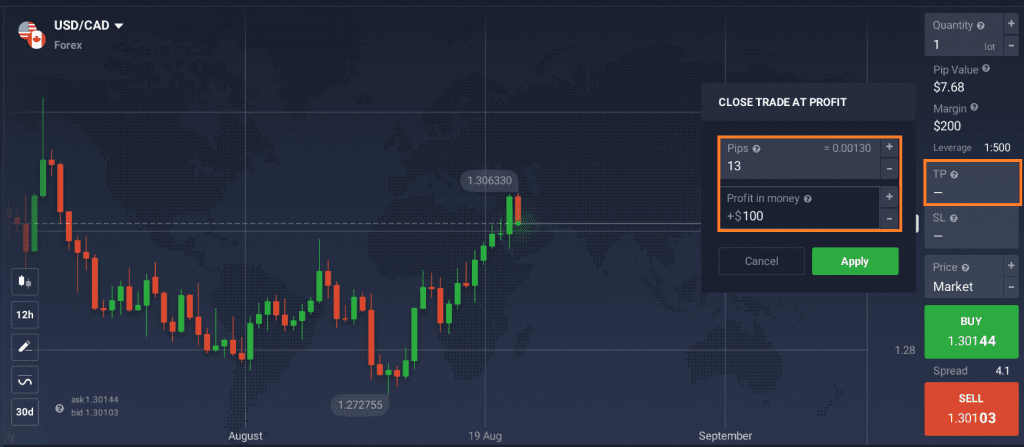

How to Set a Take-Profit Order?

Just like when using Stop-Loss in trading, you can set a Take-Profit for your deals by indicating a pip value or a certain amount of money. For instance, you would like the position to close at a $100 profit (which is currently 13 pips for this asset). Here is how the set-up could look like in the traderoom.

How to Use Stop-Loss and Take-Profit for Optimal Results?

Markets can be volatile and create strong price fluctuations. Using Stop-Loss and Take-Profit in trading may help you get the most out of these turbulent conditions. Here are a few things to keep in mind when considering including these tools in your trading strategy.

- Carefully choose the stop-loss levels based on the amount of capital you are ready to risk at the moment. Especially when margin trading, which involves trading with higher amounts borrowed from the broker. Remember that some experts suggest investing no more than 2% of your capital in a single deal.

- Use technical analysis to identify the best Stop-Loss and Take-Profit levels for your trades. For example, support and resistance lines help catch the best time to enter or exit the market. To get additional information about these tools, take a look at this video tutorial from IQ Option.

You can also use different technical indicators, such as Bollinger Bands and RSI (Relative Strength Index).

- Consider volatility for specific assets you are trading. It may vary considerably, which can affect trading results. For example, if a stock price tends to fluctuate a lot, you might want to set larger Stop-Loss and Take-Profit orders. This requires higher risk tolerance and could lead to bigger losses, so analyze the asset’s past performance before making a move.

- Although Stop-Loss and Take-Profit are most commonly used with Forex, traders can often apply them with other assets, such as stocks, commodities, crypto, ETFs. What is more, they can be used for both long and short trading positions.

Keep in mind that setting Stop-Loss and Take-Profit orders does not mean you have to wait for them to be executed to close a trade. You can exit a deal at any time, the orders will be cancelled automatically. However, sometimes it may be better to let your trading strategy play out instead of exiting trades prematurely. You should always remember about trading psychology and try to make decisions based on facts and logic instead of emotions.

Key Takeaways

Stop-Loss and Take-Profit are useful tools for maximizing profits and limiting loses in trading. By setting these automatic orders, traders can benefit from price volatility and protect their capital. Technical analysis instruments (support and resistance lines, indicators) may help choose the appropriate Stop-Loss and Take-Profit levels for each asset.