There are always stocks that seem to be on everyone’s mind: they often appear in market overviews and analysis. Some even make it into social media and become a topic of discussions on online platforms like Reddit and Twitter. You have probably heard of them – such assets are often called meme stocks. Keep reading to find out what they are and how you can trade them.

What Are Meme Stocks?

Actually, a meme stock is not much different from any other similar asset. It is a share of a public company that is traded on the stock exchange. However, meme stocks always draw a lot of attention and become increasingly popular on different online platforms, such as forums (like Reddit) or social networks.

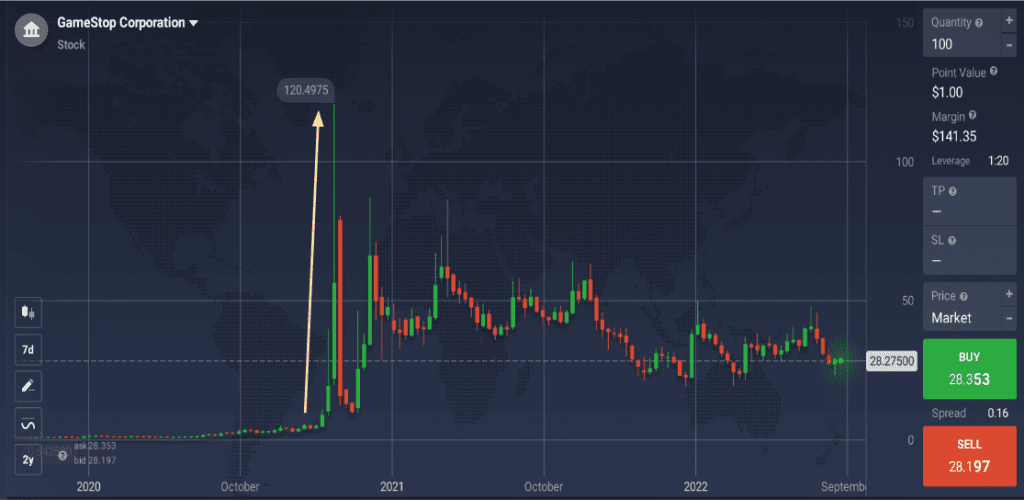

It all started in January 2021, when the stock price of a video game retailer GameStop suddenly soared and reached unprecedented heights in just a few days. In April 2020, the share price was just $2.57; by January 27, 2021, it skyrocketed to $347.

What was the reason behind this unexpected surge? As it turned out, the stock was hyped up on the Reddit’s WallStreetBets forum and presented as an undervalued asset with a lot of potential. The forum’s members targeted GameStop to drive up its price and squeeze the short sellers, who were expecting the stock to go down. It worked – at least, for some time.

Following GameStop, the sentiment soon spread across other stocks such as BlackBerry Ltd., AMC Entertainment Holdings and Bed, Bath & Beyond Inc. These are just a few of the most traded meme stocks, but they all follow a similar pattern of gaining popularity in the stock market.

How Do Meme Stocks Work?

First, people start discussing some stock on different platforms, such as online forums and social media, attracting more and more attention to this asset. Others become interested and spread the word further. As a result, the trade volume increases and the stock price goes up. However, the momentum often doesn’t last long, and soon the stock price may crash back to its original value.

Still, even a brief increase in share prices can bring considerable profits to regular investors. That is, if they understand how to trade meme stocks and manage to catch the right moment to make a move. On the other hand, such drastic price fluctuations often hurt professional hedge funds who are short-selling these assets (opening short positions and expecting share prices to go down).

When meme stocks first appeared, many considered them a temporary phenomenon that wouldn’t be around for long. By the end of 2021, the general sentiment was that the meme stock fever was coming to an end. However, it now seems that they are here to stay, so we might as well try to figure out why they attract so much attention.

Why Are Meme Stocks Popular?

Some people find meme stock trading fun – it’s a chance to own a hype asset and become a part of the trading community. Others may be looking for short-term trading opportunities, as a meme stock’s price can go up quickly, powered by a surge in traders. However, It can often go down just as fast, so you should keep that in mind if interested in meme stock trading.

What most meme stocks have in common is their low price, which attracts retail investors with limited funds. And with the growing number of trading enthusiasts in the past several years, meme stocks may seem like an easy chance to earn without risking large funds.

What Are The Most Traded Meme Stocks

Meme stock trading emerged quite recently – a few years ago this term did not exist. Currently, there are several assets that are considered meme stocks. Let’s take a look at them to understand why they may be interesting to regular traders.

GameStop Corporation (GME)

This video game company has claimed the title of the first and one of the most traded meme stocks. It had been struggling for several years before 2020, as many consumers started buying games online instead of the company’s retail stores. The situation worsened during the Covid-19 pandemic, and the share price was just around $4 by the end of 2020. So it’s not surprising that the dramatic price increase at the beginning of 2021 came as a shock to many investors.

Now, more than a year after it first appeared on the Reddit’s WallStreetBets forum, the stock price remains at around $28. This is a sharp decrease from the previous numbers, but still higher than its price before 2020, even after a 4-for-1 stock split in July 2022.

According to its financial report for the 2nd quarter of 2022, the company once again saw a decrease in sales. However, it has recently launched its own non-fungible token (NFT) marketplace and announced a new partnership with crypto platform FTX. This means that we might still hear more about GameStop in the future. So it could be a good idea to keep an eye out in case an interesting trading opportunity presents itself.

AMC Entertainment Holdings Inc. (AMC)

This cinema theater chain also struggled due to the pandemic and social distancing rules over the past couple years. Moreover, similarly to GameStop, it was also finding it hard to compete with online services. With a variety of online streamers like Netlfix, Disney and others, it was getting harder for cinema theaters to attract people and increase profits.

By the end of 2020, the AMC share price was just over $2. It all changed on January 27, 2021, when the price reached $20 after the stock got featured on a Reddit forum. It declined soon afterwards, just to surge to new heights in May 2021, when the price increased over 160%, making it another one of the most traded meme stocks.

Now, months after the last price surge powered by online followers, AMC still manages to stay a point of interest for many investors. In March 2022, it announced purchasing a major stake in a Hycroft Mining Holding Corp (a gold mining company), which many considered an unexpected decision. It has also introduced a new share class called APE – a move that may help AMC take advantage of its current popularity and raise some additional funds. The company’s stock is now trading at around $12, so there may be more trading opportunities ahead, if you choose to keep track of this asset.

Other popular meme stocks include:

- Software company Blackberry Ltd;

- Domestic merchandise chain Bed, Bath & Beyond Inc;

- Spaceflight company Virgin Galactic;

- Telecommunications company Nokia Corp;

- Automotive company Tesla, Inc.

How to Trade Meme Stocks

If you consider trying out a meme stock trading strategy, there are a few important factors to keep in mind.

Volatility and Risk-Management

It’s better to decide how long you are planning to hold your position from the get-go. Meme stocks tend to be volatile, which could offer interesting trading opportunities. But it may also involve additional risk to your capital. So consider applying risk-management tools, such as Stop-Loss and Take-Profit to cut potential losses and maximize profits.

Asset’s Real Value

When it comes to real value of meme stocks, it’s not necessarily superior to other assets. One of the key factors driving their popularity is social sentiment, not real data (such as financial or corporate performance). So if you are looking for short-term trading opportunities, understanding the true value of meme stocks may not be essential.

However, if your goal is more long-term, and you plan to hold on to this position for a while, then it’s a different story. In this case, you can dive into the company’s financial reports and apply fundamental analysis to get the facts straight before making a deal.

Accurate Timing

One of the most important things to consider in trading is timing: when to open or close a deal for optimal results. With volatile assets, such as meme stocks, choosing the right moment to enter or exit a trade is even more critical.

To get the time right, you can monitor online forums (like Reddit) and social media to catch news and events that may affect stock prices. For instance, you have probably heard that Elon Musk’s tweets often create a lot of hype around different assets. GameStop was one of them: after his tweet the share price gained almost 158% in January 2021.

In Conclusion

Many experts agree that meme stocks have become a part of the stock market reality. Even though they often add more volatility and uncertainty, meme stock trading may still present interesting opportunities for keen investors.

If you decide to trade meme stocks, you should carefully consider the risks and apply tools such as Stop-Loss to manage them. It may be tempting to go all in to get more profit, but try not to get too invested in these hype assets. Keep in mind that their movements are often too unpredictable for an effective long-term trading strategy.