Forex trading used to require large investments: hundreds and thousands of dollars. But what about those who can’t put such amounts into trading right away? In this case, IQ Option comes to the investor’s rescue, offering IQ Option margin Forex trading, that is, trading using the broker’s funds secured by a pre-agreed amount (margin). Thus, one can trade Forex with more considerable funds despite being at the beginner stage.

☝️

KEY INSIGHTS

- Margin Forex trading facilitates trading with higher amounts borrowed from the broker and secured by a pre-set amount.

- Margin is the amount of money that a trader needs to put forward in order to open a leveraged position.

- Leverage is the practice of using borrowed money to trade bigger volumes than a trader actually has on hand.

- Forex on margin is traded not in traditional monetary denominations but in lots — the number of currency units you will buy or sell. 1 lot = 100,000 units of the base currency, 1 mini-lot = 10,000 units, 1 micro-lot = 1,000 units, and 1 nano-lot = 100 units.

- The minimum margin requirement at IQ Option is 0.2% of the investment amount. It will be calculated automatically and “frozen” on the balance.

What is margin trading?

Margin is inherently the same as a traditional loan. For example, you get a mortgage on a house: you pay the first instalment and borrow the rest from the bank. The house itself is used as collateral for the loan. If you fail to pay off the debt, the bank will take the house to cover the loss.

When trading Forex on margin, the bank is your broker, and the loan is called leverage. For example, a 1:30 leverage means that you can control a trade worth 30 times your initial investment.

Example:

If you invest $30 with 1:30 leverage, you control a position of $900.

Margin is the amount of trader’s funds required to open a leveraged position. Essentially, it’s a deposit on your trades expressed in percentage that covers the broker’s risks. It’s not to be forgotten that margin trading implies not only potentially higher profits but also potentially higher losses.

Margin Forex vs. Forex without margin

One of the most striking differences of margin Forex from CFD on Forex is that currencies are traded in specific amounts called lots instead of a familiar currency denomination. Basically, a lot is the transaction amount, i.e., the number of currency units you will buy or sell.

The standard lot equals 100,000 units of the base currency. There are also mini-lots (10,000 units or 0.1 lot), micro-lots (1,000 units or 0.01 lot), and nano-lots (100 units or 0.001 lot).

For example, if a trader buys a EUR/USD nano-lot at 1.1720, they buy 100 EUR for 1.1720 X 100 = 117.2 USD per lot.

The margin interface also boasts an improved trading portfolio. It stores more detailed information about your active and pending positions and allows you to control your deals more efficiently.

The Portfolio section features the basic information such as the name and type of the asset and the trade creation date, the trade size and direction, Take-Profit and Stop-loss levels, the current price of the asset, swap fee and other commissions (if applicable), results in %, Gross/Net P/L, the current Profit/Loss ratio, etc.

What percentage of the trade is the margin?

Margin is the amount of money that will be frozen on your balance in order to open a leveraged position. The margin amount varies depending on the trade size. The minimum margin requirement is 0.2%. It’s calculated according to the following formula:

Margin = Lot size × Contract size / Leverage

The good news is that margin is calculated automatically when you enter the investment amount on the IQ Option platform, so you don’t have to.

Example:

Imagine you want to buy 0.001 lots (1,000 units of the base currency) of the EUR/USD currency pair.

Leverage: 1:30

Contract size: 100,000 units of the base currency

Margin = 0.001 × 100,000 / 30 = 3.33 EUR

The margin amount is not deducted from the balance right away but is frozen (in contrast to CFD). Note that if your account currency differs from the base currency, you might be in for a small conversion fee.

Margin Forex conditions

| Minimum investment | 0.001 lot |

| Assets | 35 |

| Leverage | Up to 1:500 |

| Spread | From 0.7 pip |

| Minimum margin | From 0.2% |

| Take profit/Stop Loss | Yes |

| Swap | 0% |

How to trade Forex on IQ Option with margin

1. Log in or register

If you already have an IQ Option account, log in with your email and password. First-timers need to register a new account using their email address or social networks.

Upon registration, the new trader gets access to 2 account types: Real and Demo aka Practice. You can start trading on the demo account right away: learn the interface, test strategies, etc. The demo account is charged with virtual $10,000 that you can replenish anytime.

2. Make a deposit

If you want to trade on the real market, you need to charge your account with some money. The minimum deposit amount is $10 or the equivalent in your account currency. IQ Option does not charge commission on deposits, yet your payment system provider might.

To make a deposit, click the Deposit button in the upper right corner of the Traderoom. Next, choose a payment method, enter the desired amount, and press Continue.

For more details, read our step-by-step guide on deposits.

3. Open a margin Forex deal

1. Choose a currency pair you want to trade.

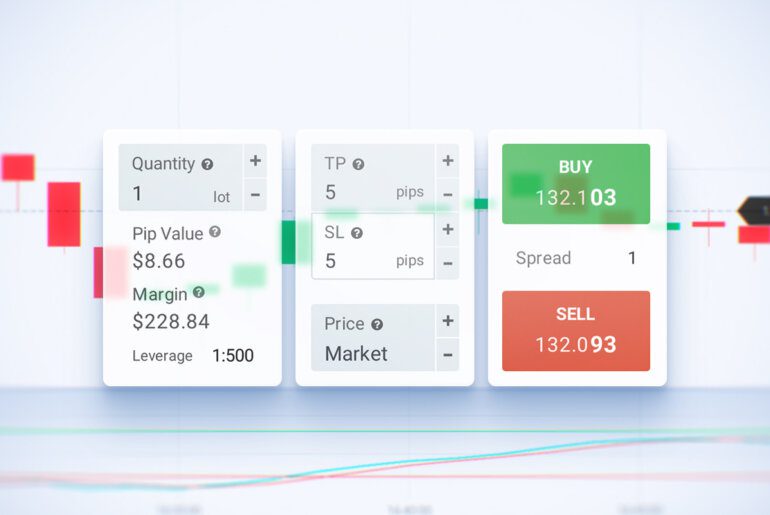

2. Specify the trade size in the Quantity box in the right-side panel. The pip value for the chosen asset and margin for your trade will be calculated automatically.

3. Manage risks with Take-Profit and Stop-Loss. They will auto-close the trade once your profit/loss reaches a predetermined level.

4. Analyze the price movement with technical indicators. MACD, RSI, Bollinger Bands, Stochastic Oscillator, and Parabolic SAR are commonly used for Forex trading. Go to the Indicators tab in the bottom left corner of the Traderoom, choose a necessary tool, set it up, and press Apply.

For fundamental analysis, IQ Option features a regularly updated newsfeed and a Forex calendar with important upcoming events. Both are accessible from the Market Analysis section on the left-side panel.

5. Make a prediction about the price movement. Press Buy if you think the price will go up or Sell if you believe the price will go down. Hover the mouse over the BUY and SELL buttons before opening the trade to see the details and double-check everything’s fine.

6. Close the position. It will get closed automatically in three cases:

- When the trade expires if you’ve set the expiration time;

- When the trade hits the predetermined Take Profit or Stop Loss level;

- In case your margin level goes below 50% (it’s called margin call).

To close the trade manually, go to the Portfolio section of the User Panel on the right and press X and then V in front of the asset.

Withdraw profit

To request a withdrawal, you need to get your account verified (if you still haven’t). Check out the article on verification to successfully complete the process and unlock the full functionality of the IQ Option platform.

Once the verification is completed, click on the user icon at the upper right and select the Withdraw Funds option.

The minimum withdrawal amount is $2 or an equivalent in your account currency. Each trader is eligible for 1 free withdrawal per month. If you’d like to cash out more often, you’ll have to pay a 2% fee, yet no more than $30. Normally, the request is processed within 1-3 days.

For more information on how to cash out at IQ Option, check our complete withdrawal guide.

Conclusion

Many traders used to ask, “Can I trade Forex on IQ Option with margin?” Now, the answer is yes! IQ Option margin Forex trading offers a number of advantages for traders. Most importantly, it makes it possible to control larger amounts than traders really have, which means potentially higher profits (but also higher losses!). Besides, margin Forex is traded in lots, which is traditionally a more familiar way to trade currency pairs.

IQ Option’s Margin Forex features tight spreads, dozens of currency pairs, no commissions on deposits, convenient withdrawals, and 100+ technical indicators. Margin Forex is suitable for beginners thanks to a $10,000 demo account, a minimum deposit of only one nano-lot, and, of course, a leverage of up to 1:500.