The season for exploring stocks to invest in 2024 is open! Traditionally, investors are actively considering penny stocks — the kind one might proudly claim: “I got it for a few cents, and then its value soared!”. Here’s a selection of both the best penny stocks to buy in 2024 and well-established, reliable dividend stocks, available for trading as CFDs on the IQ Option platform.

What Are Penny Stocks?

Traditionally, penny stocks were classified as securities valued below $1. However, according to the latest definition by the US Securities and Exchange Commission (SEC), penny stocks are securities with prices below $5. These stocks attract investors with limited financial resources seeking affordable assets.

Exploring the Best Penny Stocks to Buy in 2024

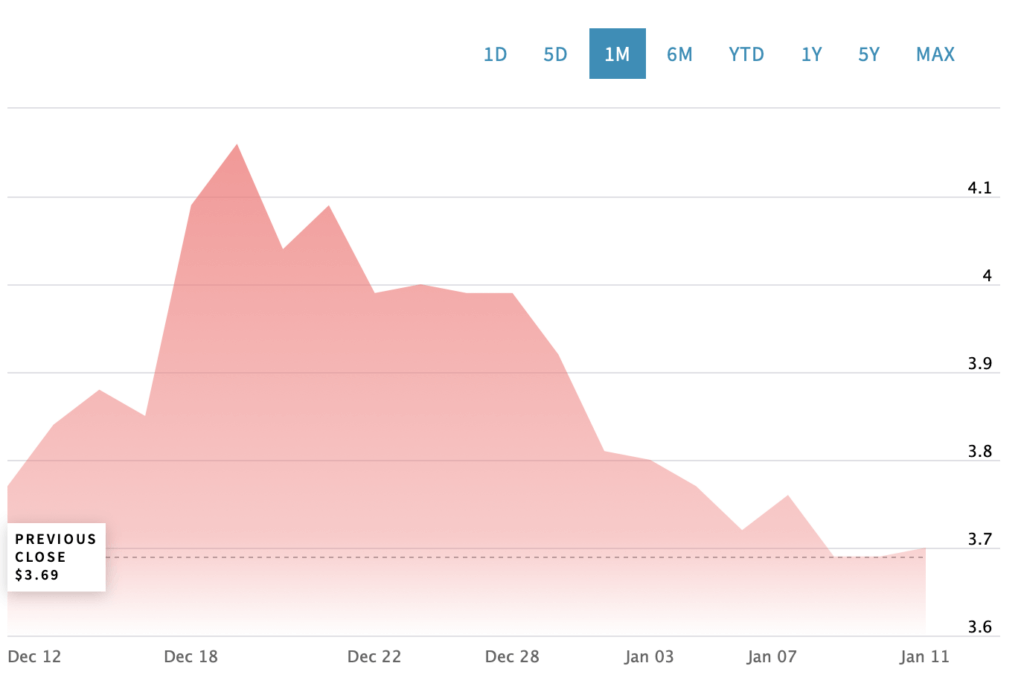

Vimeo, Inc. (VMEO)

Vimeo, Inc. witnessed a surge in its shares following impressive Q3 results, with revenue exceeding estimates at $106.3 million. The company attracted investments from 42 hedge funds out of 910 in Insider Monkey’s database, which might also be an encouraging sign for penny stock investors.

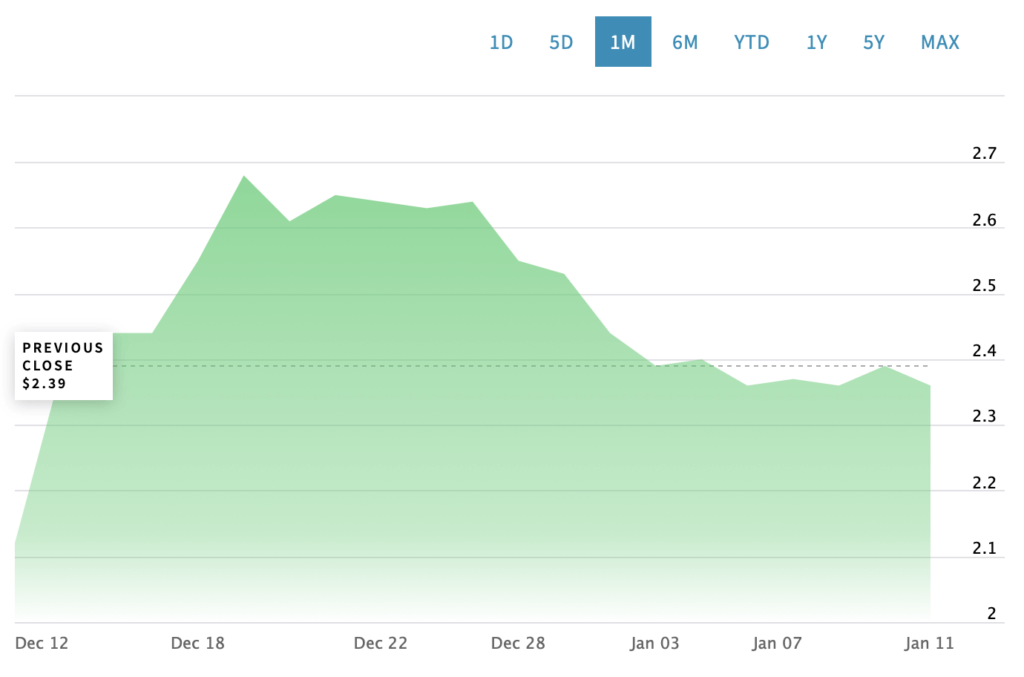

IAMGOLD (IAG)

NASDAQ mentions IAMGOLD, a gold miner company, among the best metal penny stocks to buy. Reasons: gold’s bullish trend and the company’s sufficient liquidity allowing it to invest in attractive project pipelines. Analysts anticipate IAG stock to double over the year if gold remains bullish.

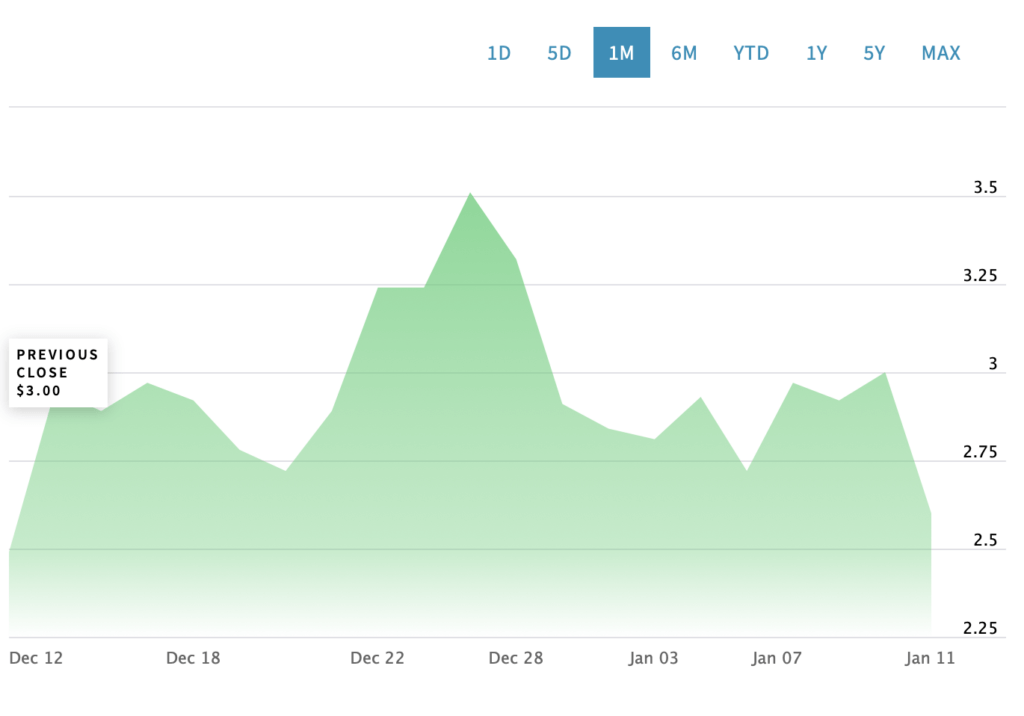

Bitfarms (BITF)

Bitfarms has surged 550% in the last year, driven by a bullish Bitcoin trend. The company’s aggressive expansion is expected to fuel robust revenue growth. With Bitcoin mining costs at $16,900 in Q3 2023, potential EBITDA margin expansion and increased financial flexibility position Bitfarms for further expansion.

Best Dividend Stocks 2024

While exploring penny stocks to buy in 2024, it’s essential to consider a well-rounded portfolio, including dividend-paying stocks. Here are a few dividend stocks from different sectors to keep on your radar:

Telecommunications — Verizon Communications (VZ)

Verizon offers a substantial 6.6% yield, despite its less popular standing among investors due to sluggish business growth. The company’s low payout ratio of 53% and a consistent 17-year streak of dividend increases make it a potentially reliable choice for long-term dividend investors, with its ability to weather economic challenges.

Energy — Devon Energy (DVN)

Devon Energy boasts an appealing dividend yield of 6.3%, and with its dividend performance closely linked to the dynamics of oil and natural gas prices, it presents an opportunity for potential growth, particularly in times of increasing energy expenses.

Healthcare — AbbVie (ABBV)

AbbVie has sustained its tradition of annual dividend increases, exhibiting a 3.8% yield with a remarkable 287% payout growth over the past decade. Despite challenges posed by the loss of market exclusivity for Humira, its leading drug, AbbVie has strategically invested in new growth drivers like Rinvoq and Skyrizi, both showing substantial sales growth.

Financial services — Bank of America (BAC)

The bank has demonstrated robust dividend growth, increasing payouts by 60% over the past five years. Despite concerns about potential lower interest rates in 2024, Bank of America’s recent accolades, including being named the best bank in North America and the world’s best digital bank, highlight its strong position in the financial services industry. With a focus on innovation and a track record of success, Bank of America appears well-positioned for long-term growth.

Stocks to Invest in 2024: A Wrap Up

Compare penny stocks to buy in 2024

| Company | Sector | Market cap | YTD performance |

| Vimeo, Inc. (VMEO) | Technology | 618.51M | -2.38% |

| IAMGOLD (IAG) | Basic Materials | 1.15B | -11.48% |

| Bitfarms (BITF) | Technology | 973.326M | +320.83% |

Compare the best dividend stocks 2024

| Company | Sector | Dividend yield | YTD performance |

| Verizon Communications (VZ) | Telecommunications | 6.6% | +2.86% |

| Devon Energy (DVN) | Energy | 6.3% | -3.6% |

| AbbVie (ABBV) | Healthcare | 3.8% | +5.77% |

| Bank of America (BAC) | Finance | 2.8% | +0.61% |

Conclusion

Considering penny stocks to buy in 2024, dividend options, and overall stocks to invest in, is crucial for a well-rounded and strategic approach. Remember to conduct thorough research, diversify your portfolio, and stay informed about market trends to make informed investment decisions.