☝️

Trading volume is an essential technical instrument representing the activity level in financial markets. Investors, traders, and analysts use trading volume to assess the liquidity and volatility of a particular asset and make trading decisions.

This article provides a comprehensive overview of why trading volume is important for traders and investors alike. Read on to learn everything you need to know about trading volume, how trading volume affects price, and how it can help unlock profitable trading strategies. Plus, discover how to day-trade using volume and how to use volume in trading Forex to get better results.

Let’s get started!

What is Trading Volume and How It Works

Trading volume refers to the total quantity of shares or contracts bought and sold for a specific asset during a particular timeframe. It includes all the shares exchanged between the buyer and the seller in a transaction.

☝️

Trading volume is a significant metric for investors as it provides insight into the market’s level of activity and liquidity. When a particular security experiences a surge in trading volume, it indicates a higher level of liquidity, which can create more trading opportunities.

How to Enable the Trading Volume Widget on IQ Option?

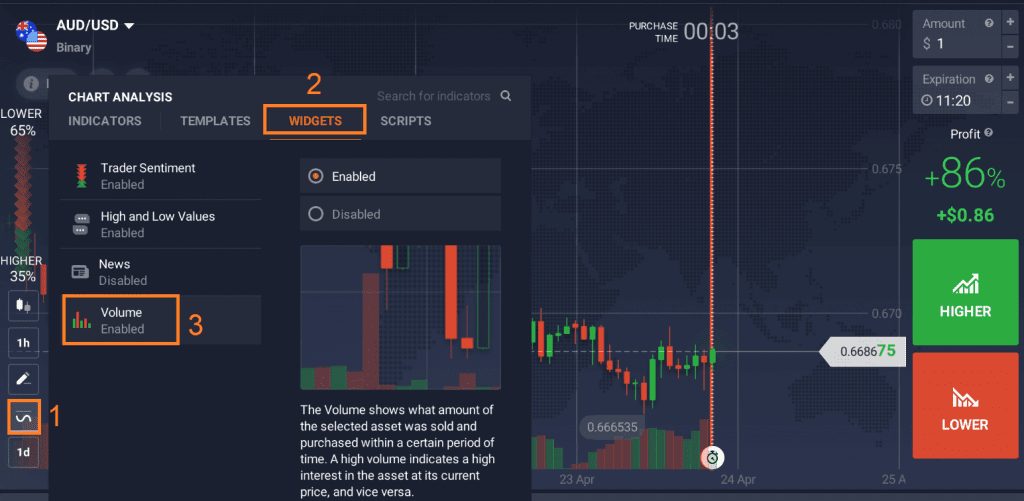

To use volume in trading any asset in your IQ Option traderoom, you need to enable it first. Here’s how:

- Log in to your traderoom, navigate to Indicators → Widgets.

2. Click Volume and then Enabled. You’ll see it appear below the chart.

How to Use Trading Volume for Successful Trading Strategies?

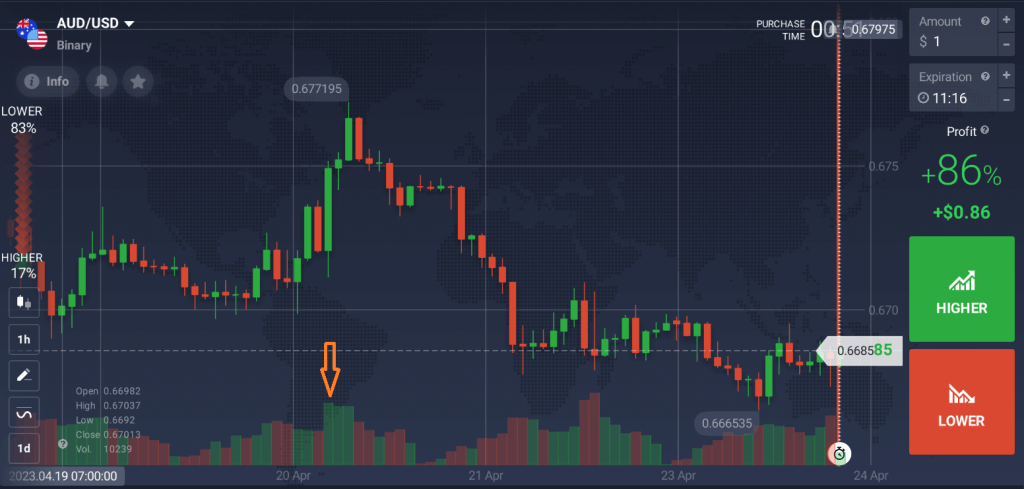

So how can you use volume in trading? This versatile technical tool can be helpful in many ways, which makes it a great addition to any trading strategy. One of the main goals of using volume for trading is to confirm the existence or continuation of a trend or a trend reversal.

☝️

It can also provide investors with signals to enter the market or take profits. For instance, when there is a significant increase in trading volume, it can be a signal for investors to enter the market, while low activity may signal the need for investors to take profits and sell a security.

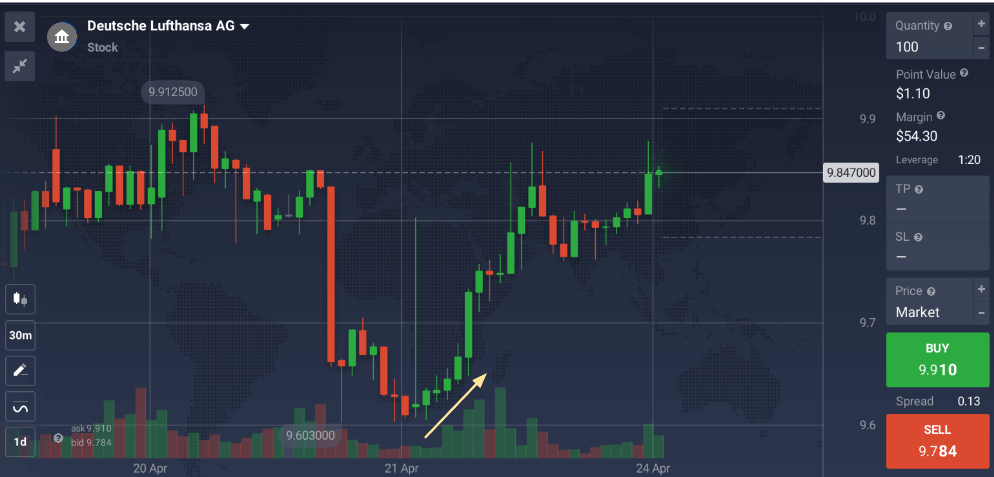

For example, here’s a stock price chart indicating increasing trading volume. You can see the increase indicated by the arrow. This means that it could be a good time to enter the market.

Tips for Using Volume in Day Trading

While trading volume can be used in both long and short-term trading, it’s especially helpful in day trading strategies.

Day trading is a popular strategy traders use to profit from short-term fluctuations in financial markets. Trading volume is a crucial tool for day traders, providing essential information about the activity level in financial markets.

One way to use trading volume in day trading is to look for a sustained increase or decrease in trading volume.

☝️

Moreover, day traders can use this tool to identify an asset’s potential support and resistance levels. Support levels are price levels where buying pressure is strong enough to prevent prices from falling further. Resistance levels are price levels where selling pressure is strong enough to prevent prices from rising further.

Trading volume measures the number of shares traded during a specific period, and it can help traders confirm or refute price signals. Here are some things traders look for.

Bullish Signals

- If the trading volume is above average or increasing, it can signal that traders are genuinely committed to a price move.

- When a stock’s price breaks through a resistance level (a point where upward trends gets weaker), the breakout is more significant if the volume is high or above average.

- An uptrend paired with increasing and/or above-average volume implies investor enthusiasm for that stock or asset is strong, which could lead to more buying and even higher prices.

Bearish Signals

- If the trading volume is below average or decreasing, it can signal a lack of enthusiasm for a price move.

- A downtrend paired with increasing and/or above-average volume implies investors have doubts about the stock, which could lead to more selling and even lower prices.

How to Use Volume in Trading Forex?

Volume can be a valuable tool in Forex trading, helping traders identify market trends and confirm price movements. Here are a few ways to use volume in trading Forex.

Look for trends

In Forex trading, an increase in trading volume often indicates a strong trend in one direction. Traders can look for volume spikes to confirm a trend and use this information to decide when to enter or exit a trade.

Identify support and resistance levels

Trading volume can also help identify key support and resistance levels. Support levels are areas where buying pressure is strong enough to prevent prices from falling further, while resistance levels are areas where selling pressure is strong enough to prevent prices from rising further. Traders can use volume to confirm these levels and make informed trading decisions.

Watch for divergences

A divergence occurs when the price of a currency pair is moving in one direction while trading volume is moving in the opposite direction. This can signal that the trend may be weakening or reversing, and traders may want to adjust their positions accordingly.

Pay attention to economic news

Economic news releases and other market events can cause significant spikes in trading volume, indicating volatility and potential opportunities for traders. By staying up-to-date with the latest news and events, traders can anticipate changes in trading volume and use this information to their advantage.

Conclusion

In conclusion, trading volume is an essential measure of market activity. It helps traders gain insights into market trends, confirm price movements, and identify potential trading opportunities. Trading volume affects price by reflecting the level of interest and participation in the market, which can indicate bullish or bearish sentiment.

Whether day trading or trading Forex, incorporating trading volume into your analysis can enhance your overall trading strategy and help you make better-informed decisions.