Ho-ho-ho, Santa’s out to make his naughty or nice list! It’s been a long year full of ups and downs, and there are some impressive winners along with sore losers. Which stocks are in the top stock gainers and losers of 2022? Let’s find out right now!

Top stock gainers

Starting with the absolute winners, these stocks have shown significant growth over the past year. To answer the question whether this trend will continue or not, we need to take a closer look at the companies’ performance.

First Solar, Inc.

Opening the list of top stock gainers in 2022, First Solar is proving that solar energy is here to stay, and that the demand for it will only increase in the future. One of the main catalysts for the stock’s growth is the environmental regulations for reducing the carbon footprint around the world. The company’s revenues and EPS have shown significant increase and the stock has gained +89% YTD.

EQT Corporation

One of the largest U.S. gas producers, EQT Corporation has had a great year, gaining +74% YTD. With the increasing demand for natural gas, the company is now one of the most popular stocks among investors and traders. However, there are some threats to watch out for: the volatility of crude oil prices and regulations could potentially harm the stock’s performance.

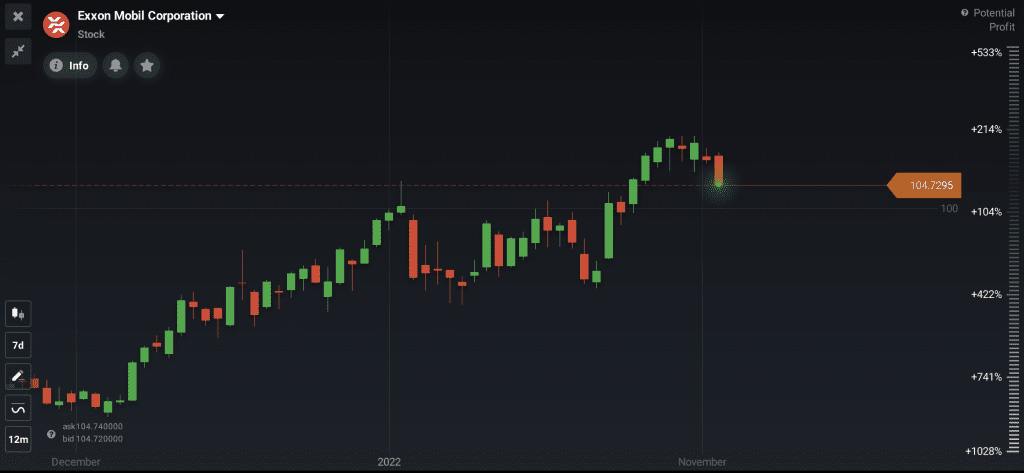

Exxon Mobil Corporation

Another one of the top gainers in 2022 is Exxon Mobil Corporation — one of the leading oil and gas companies in the world, which is up by 74% YTD. Its consistent growth that has been observed over the past year is expected to continue in 2023, as the demand for crude oil is only increasing.

ConocoPhillips

One more major energy company, ConocoPhillips is a crude oil and natural gas producer. Along with the other giants, it has long dominated the market and managed to grow by 63% YTD in 2022. The company’s plan to expand its business and diversify its revenue base makes some analysts believe that higher highs may be reached soon.

Top stock losers

In contrast with the top stock gainers, these companies didn’t have the best year and have shown considerable losses.

Coinbase Global, Inc.

The leading cryptocurrency exchange is the headliner of the losers list this year. Despite its strong brand, the company’s stock is down by 82% YTD. Indeed, 2022 was not a very strong year for cryptocurrency as a whole. The volatility of crypto and the distrust of investors after the FTX’s bankruptcy has the potential to further harm Coinbase’s revenue and weaken the stock’s performance. Can the user-friendly platform recover and regain momentum in 2023? Time will tell.

Beyond Meat, Inc.

Beyond Meat is a well-known producer of plant based meat products. Despite the great performance of the stock after the IPO in 2019, the company has been struggling all year of 2022 and is currently at -78% YTD change. Strong competition from other producers of plant based alternatives to meat like Tyson Foods is hurting the company’s profitability. Beyond Meat has experienced a strong decline in sales and some investors believe that a reverse of the bullish trend should not be expected soon.

Snap, Inc.

The effects of the slowing economy as well as changes to the online ads tracking mechanism at Apple have had a negative impact on Snapchat’s parent company. The Snap, Inc. stock has fallen approximately 77% YTD. The company offers a unique and simplistic mobile platform and is planning to make it even easier to use for people of all ages. Snap also plans to change their work model in the beginning of 2023, making employees spend 80% of their working time in the office. The change is expected to boost the staff’s productivity and the company’s revenue growth.

Lyft, Inc.

Lyft is a ride-sharing company that provides its services in the US and Canada. The company’s stock has underperformed the broader market in 2022, and is down 75% YTD. Many investors are skeptical about the company’s prospects, as the app is struggling to attract and maintain customers. Lyft is developing new rewards programs, however the costs that will be incurred may mean that it might take a while for the stock to recover.

Will you trade any of these stocks in 2023? Let us know your opinion in the comments below!

Please note that the assets are assessed based on their performance and fundamentals, however this evaluation does not guarantee the performance of the asset and is not an investment advice.