The markets have been especially volatile lately, forcing investors and traders to look for new strategies. If you are into stock trading, keep reading to find out which stocks may offer the best trading opportunities in the coming months.

Which Stocks to Trade Now?

There are different approaches to choosing best stocks for trading. They include fundamental analysis – monitoring a company’s financial information, as well external and internal factors that may affect its performance. This method can be used on its own or together with technical analysis. The latter involves application of trend lines, indicators and other technical tools.

News trading can also be a useful strategy for stock analysis. It involves following economic and political events to catch the optimal time to make a trade.

We have collected 3 promising stocks you might want to consider including in your trading strategy. Check them out to learn more about stock trading and find the best opportunities for you.

Lyft, Inc.

Founded in 2012, Lyft has become the second-largest ride-sharing company in the U.S. by 2022. It offers taxi services, shared rides, rental cars, delivery and a bicycle-sharing system in the U.S. and Canada. It has recently reported strong 2nd quarter 2022 earnings, beating revenue expectations ($990.7 million – over 20% increase from last year’s figures for the same quarter). There was also a 16% increase in active riders, which is the best result since the beginning of the Covid-19 pandemic. This caused a considerable rise in the company’s stock price.

However, net loss for the 2nd quarter went up as well. To address this, the company is reorganizing its workforce, exiting some less successful projects (like e-scooters) and focusing on the key services bringing most profits.

Despite its success in the ride-sharing industry, Lyft is still looking for more growth opportunities. For instance, in 2020 the company acquired Halo Cars – a service that pays drivers to display digital advertisements on top of their cars. And in August 2022, it announced the creation of Lyft Media – a new project with a focus on advertising. It will involve tablets installed in the cars that show ads to riders, which might help increase revenue by attracting more advertisers.

Lyft has also partnered with an autonomous vehicle company Motional to create an all-electric robotaxi service. It has officially launched to the public in Las Vegas in August 2022 after 4 years of testing and will be expanding in the future.

Lyft vs. Uber Stock

The competition is fierce: Lyft’s main rival Uber is also showing growth and exploring new horizons. It has successfully developed its food delivery service, which brought great results during the pandemic. Lyft has also tried to venture into this industry by partnering with Olo – an online ordering platform. But unlike Uber Eats, it just delivers orders from restaurants and doesn’t have a platform directed at consumers.

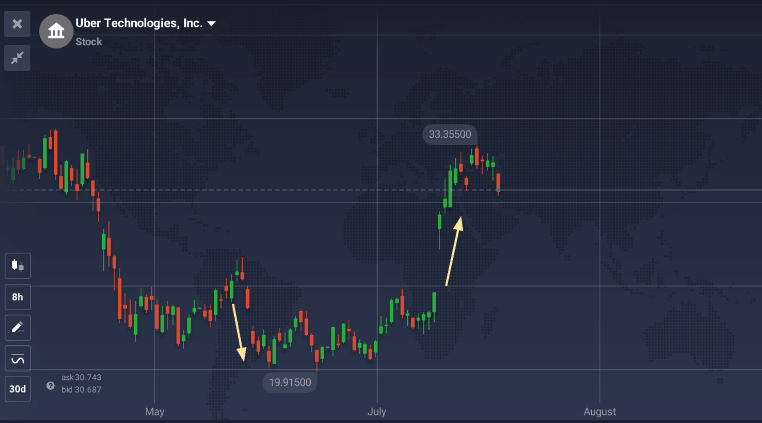

Currently, Uber has an advantage when it comes to size: it controls 70% of the U.S. market and operates globally. Lyft has a smaller market share in the U.S. – around 29% – and works only there and in Canada. Yet, it seems that both companies are struggling with similar issues: recovering after the slowdown during the pandemic, dealing with the rising fuel prices and exploring new ways to boost revenue. Uber’s 2nd quarter financial results included a considerable net loss, which forced the stock price to decline.

The stock price recovered shortly after the deep, but it is still very far from the 2021 numbers. So it is up to you to decide which stock is better for your trading strategy and has the potential to bring more profit.

First Solar, Inc.

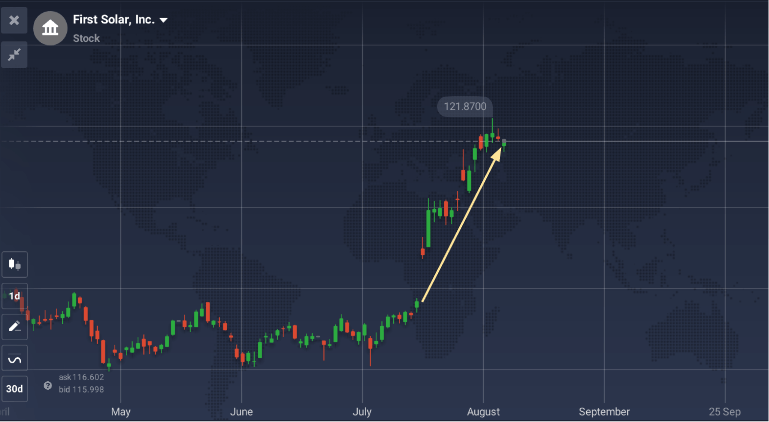

The Inflation Reduction Act passed by the U.S. Congress and signed into law on August 16, 2022, will potentially have a big effect on the solar industry. It includes large investments in the renewable energy sector, which will benefit companies involved in it. This law comes at an important time for companies like First Solar, as they struggle with increasing material and production costs.

First Solar – an American solar technology company founded in 1999 – produces advanced thin photovoltaic (PV) panels. It offers them as a more nature-friendly lower-carbon alternative to traditional solar panels. The company showed a rise in sales and profits in its 2nd quarter financial report, which contributed to the recent stock growth together with the new legislation.

First Solar Stock: Buy or Sell?

Currently, First Solar is planning to increase production by building two new manufacturing plants. This may help it benefit from the increasing solar panel prices. With the growing demand for renewable energy sources around the world, First Solar has the potential to become one of the industry leaders. However, it may take some time for the stock price to reflect these changes, making it a promising stock to trade. So you might want to track the price fluctuations and use technical analysis to catch the best time to make an entry.

Micron Technology, Inc.

Micron is one of the world’s largest semiconductor companies that produces memory and storage solutions. Their products are used in electronics, cars, computers and other essential appliances. Yet, it still faces stiff competition from other companies in this sector, especially those based in East Asia (three-fourth of the world’s semiconductor chips are produced there).

Meanwhile, the recent CHIPS and Science Act signed into law in the U.S. might change this situation. It will offer support to American chip manufacturers, such as Micron, AMD, Intel., and motivate them to increase production in the country.

Micron has already reacted to this news by announcing a $40 billion investment in its U.S. based production using the grants and credits offered by the new Act. By expanding manufacturing, they promise to create thousands of jobs. As the demand for chips will continue to increase, there is a lot of potential for growth in this sector.

Is Micron Stock a Good Buy?

Micron stock price declined 5% following the release of its 2nd quarter financial report. Even though the report figures showed a rise in revenue, it also included a less optimistic outlook on future results, which worried some investors. Then the stock price grew slightly in reaction to the CHIPS and Science Act being passed by the U.S. Congress.

Along with the lowering demand for some of its products, Micron is also facing challenges common for the whole industry (e.g.supply shortages). However, with the support of the CHIPS and Science Act, Micron is looking to expand its production and continue growing. This could affect the price in the future and make it one of the most promising stocks for trading.

Which stocks would you consider for your trading strategy? Please share your ideas in the comments and let us know if you would like to get more market overviews on this blog!