The economic calendar can be a useful tool for asset analysis. By referring to it, traders can catch important events that may cause market volatility. Moreover, the economic calendar trading strategy may suit both beginners and experienced traders. So let’s dive in and figure out how to use the economic calendar for trading and get positive results.

How Does Economic Calendar Work?

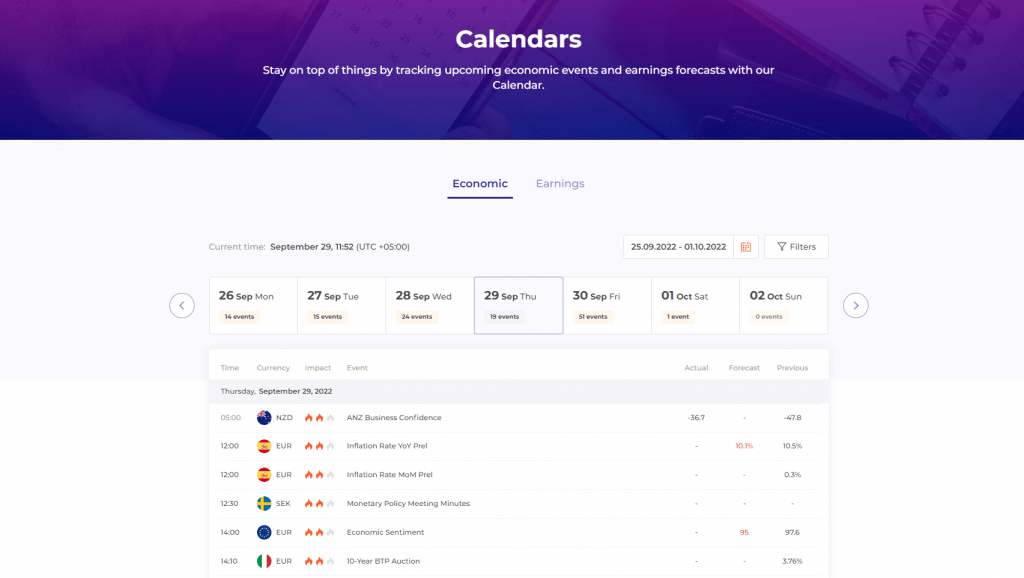

You may find slightly different versions of economic calendars on various resources, but most of them have a similar structure. Let’s take a look at the economic calendar on the IQ Option website as an example.

There are several important parts of the calendar that may provide useful information for your trading. To get a better understanding of how it works, we will cover each part separately.

Date and Time

The economic calendar shows the most important events in the financial world that take place on particular dates. You can check the date you are interested in by clicking on it in the upper section of the calendar. There is also an option of applying a date range to analyze past events. The date and time are automatically set according to your current timezone.

Main Points of Interest

There are several key features of the economic calendar that you may find useful. On the left side, you can see the time of the event, its name and the main currency that is connected to it.

There are different types of events that can be reflected on the economic calendar. They include governmental reports on the inflation rate and unemployment, important speeches that may provide valuable information about the economy, etc. If you would like to learn more about a specific event, just click on it to see the details.

For instance, take a look at this event – Unemployment Rate in Japan. Right at the top, you can see the list of assets that may be affected by it, followed by some background information.

On the right side of the screen, you can see three columns with different numbers. They indicate the figures related to each event. Actual column stands for the final result, Forecast refers to the expected figures and the Previous section provides past data.

One of the most interesting features is the Impact column. It provides insights into the potential effect this event may have on the volatility of the indicated assets and the market in general. The impact value ranges between “Low”, “Medium” and “High”.

Filter

If you would like to get information about some particular events or a region, you can opt to use the Filter feature. It allows you to choose specific countries and event categories, as well as their potential impact value.

How to Read the Economic Calendar?

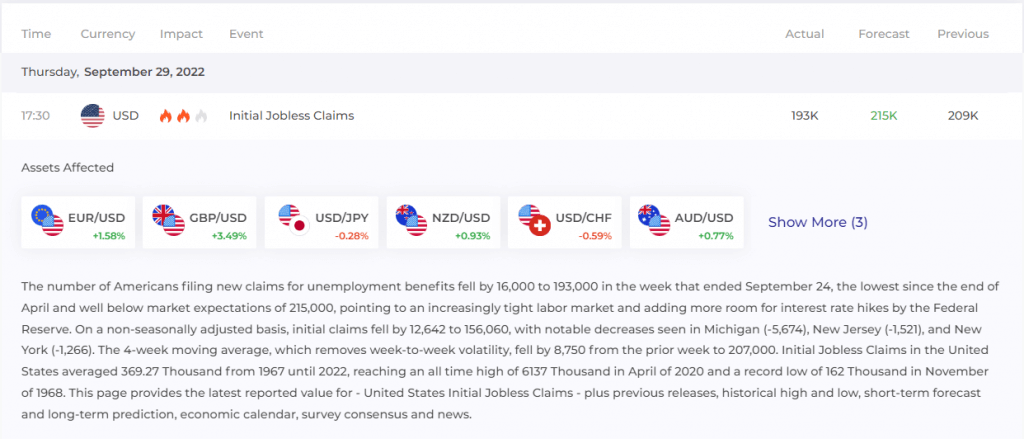

Now that we have covered the main sections of the economic calendar, we can learn how to understand it and use this information in trading. To achieve this, let’s get take a look at another example – Initial Jobless Claims in the U.S. This is an event with the “Medium” impact value that was scheduled for Thursday, September 29.

To figure out how it may have affected the market, we can examine the details and related assets. In general, Initial Jobless Claims measures the number of people who applied for unemployment insurance over the previous week.

As we can see here, the forecast was higher than the actual value. This can normally be considered as a positive (bullish) trend for the USD – the main asset connected to this event. However, if the forecast had been lower than the result, it would have indicated a negative (bearish) trend for the USD. Still, there is no guarantee that it will work accurately every time. So it may be useful to apply some technical analysis tools to confirm your ideas before making a move.

How to Use the Economic Calendar for Trading?

The economic calendar trading strategy is especially popular among Forex traders. This is because the Forex market is significantly influenced by monetary and fiscal policy changes and related announcements. However, you can use it when trading other assets as well. Monitoring the economic calendar is a good way to plan your trades and stay informed about potential risks to your portfolio.

To build an effective economic calendar trading strategy, you should consider taking the following steps.

1. Learn About Popular Economic Indicators

It might be helpful to get a more in-depth understanding of the most important terms that often appear on the economic calendar. They include GDP (Gross domestic product), CPI (Consumer Price Index), PMI (Purchasing Managers Index) and so on. This way, you will be able to react quickly to new information instead of trying to learn about these terms on the spot.

2. Plan to Check the Calendar Regularly

It’s important to plan when you’ll be monitoring the economic calendar and stick to this schedule. Otherwise, you might miss critical information that can affect your trading results.

Some experts suggest checking the economic calendar every morning before making any deals. Even if you aren’t a day trader, checking the calendar regularly to adjust your trading strategy might still be useful.

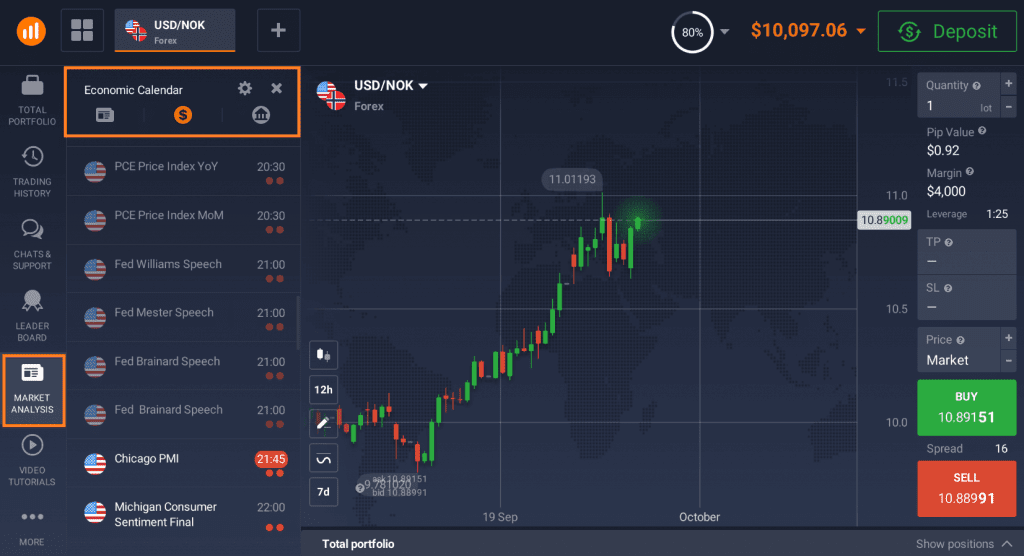

Some brokers offer the economic calendar right on their trading platforms. Here is how it looks like in the IQ Option traderoom.

3. Do Your Research

It may be a good idea to figure out what kind of events may affect the assets you are trading. By doing this, you will be able to focus on tracking the most relevant activities, which may save you some time.

In Conclusion

The economic calendar can offer useful information about significant events that may affect different assets. To use it effectively, you should learn how to read the economic calendar and understand the main economic indicators mentioned in it. Having a solid economic calendar trading strategy may help identify bullish and bearish trends and catch the best opportunities to make a trade. So if you haven’t yet used the economic calendar in your trading strategy, you may consider giving it a shot to boost your results.