The Foreign Exchange market (shortly Forex or FX) is a global marketplace for the currency exchange, where currencies are traded against each other in pairs. Traders can pick from a variety of forex trading methods to analyze market conditions and seize great trading opportunities.

However, many beginner traders often find it hard to choose a forex trading strategy. This article covers the main steps traders should take to pick a strategy that will help achieve their financial goals.

How to Choose a Forex Trading Strategy?

When selecting the best strategy to trade forex, it’s crucial to understand what kind of trader you are and which method best suits your trading approach. Here are several important factors that may help pick the best forex trading strategy for you.

When Do You Trade on Forex?

One important feature of forex is that it is open 24 hours a day. On the one hand, it means that traders from different countries can all find a suitable time to trade on forex. On the other hand, there are busy periods when prices tend to fluctuate more, and some traders might miss them due to time difference. In addition, some currency pairs behave differently at various times of the day, depending on the number of active traders.

A typical 24-hour forex trading period consists of three sessions: Asian, European and North American. When they overlap, it creates more market activity and often leads to increased volatility. If a trader can’t monitor these periods, he or she might miss some price movements affecting their open positions. So it’s important to carefully choose the trading time that suits your method and lifestyle. Check out this article to learn more about choosing the right time to trade.

How Much Time Do You Have to Trade on Forex?

Some methods require more attention, as traders need to closely monitor price changes and make decisions fast. Others, however, are more long-term, so traders don’t need to check the deals very often and can take time to consider their actions.

How Often Do You Make Deals?

Again, with some strategies, traders are expected to make several deals a day to make a profit. On the contrary, other methods only require a few trades a month. So consider your habits and lifestyle to focus on approaches that will suit your needs.

Which Currency Pairs Do You Trade?

It is also important to decide which currency pairs you want to focus on. A currency pair is a price quote of the exchange rate for a pair of different currencies. They are commonly divided into two categories.

- Major pairs

These are currency pairs with the largest trade volume: EUR/USD, USD/JPY, GBP/USD, USD/CHF. They are commonly used for global financial transactions.

- Exotic pairs

These pairs are not heavily traded on Forex and are rarely used in the economic activities on a global level. They are usually more volatile than major pairs and include currencies from developing countries, such as the Uruguay peso and the Thai baht.

Currency pairs can be affected by a number of important factors. So traders should keep them in mind when choosing assets for trading. Here are a few things you may want to focus on.

Trade Volume

The major currency pairs have the largest trade volume and attract more traders than exotic pairs. They usually offer more liquidity as well, which decreases the spread between ask and bid prices. However, there are forex trading strategies available for both types of currency pairs, so traders just need to keep this factor in mind when choosing an approach.

Volatility

The stability of a currency is generally influenced by the economic situation of the countries associated with it. So any economic or political changes can affect the currency pairs and should be closely monitored. Exotic pairs tend to be more volatile, as they are often connected to developing countries, where the economic situation tends to be less stable.

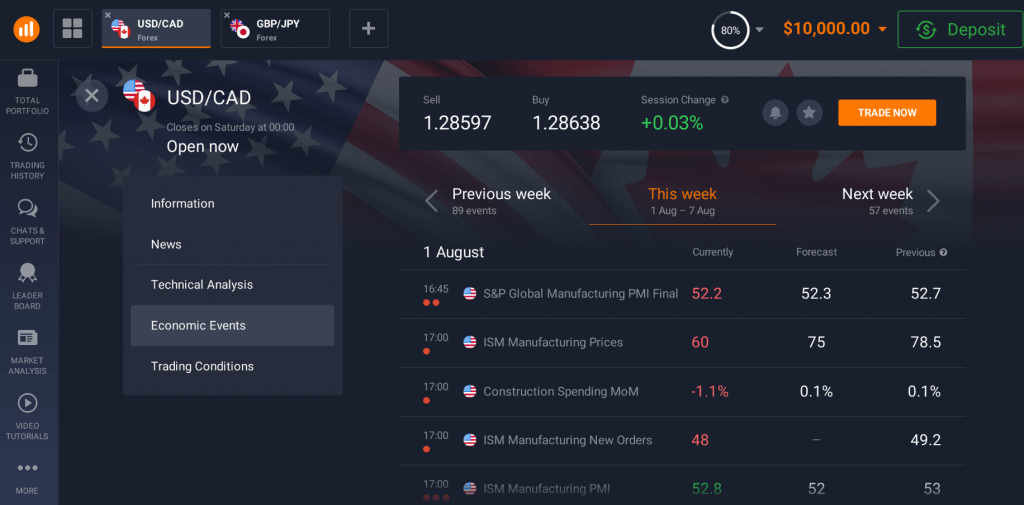

To keep track of the main events that can cause price fluctuations, traders can use an economic calendar. Some brokers even offer a newsfeed with main events on the trading platform itself for more efficient trading.

Data Availability

Some forex trading strategies involve making predictions on the currency pairs’ future performance based on historical data. With major currency pairs it’s easier to do because there is plenty of information for analysis. But with other currencies, there may not be much historical data to analyze, making predictions more difficult.

What Is the Best Forex Trading Strategy?

The best way to select a forex trading strategy would be to consider all the factors mentioned above and make a choice based on research and analysis. There is no one-size-fits-all solution, so every trader can find the strategy that will suit his or her needs.

Once you have done the research, chose the currency pairs and decided on an optimal trading schedule, there may be a few strategies that match your situation. Try them out and compare the results to choose the best forex trading strategy for you.

It is also important to remember about the Stop-Loss and Take-Profit orders. As the forex market is open 24 hours a day, it’s difficult to always keep track of price fluctuations. These orders can help traders close deals when the price reaches a certain level. By applying them to your trading, you can expect to minimize losses and get the most profit.